Planning for retirement is a big deal, and many people in Singapore look for ways to make sure they have enough income when they stop working. The AIA Retirement Saver II is one option that comes up. This article takes a look at what it offers, how it stacks up against other plans, and if it might be a good fit for your own retirement goals. We’ll break down the details to help you figure out if this plan is the right choice for your future.

Key Takeaways

- AIA Retirement Saver II offers various payout options, including 15 and 20-year terms, starting from age 65.

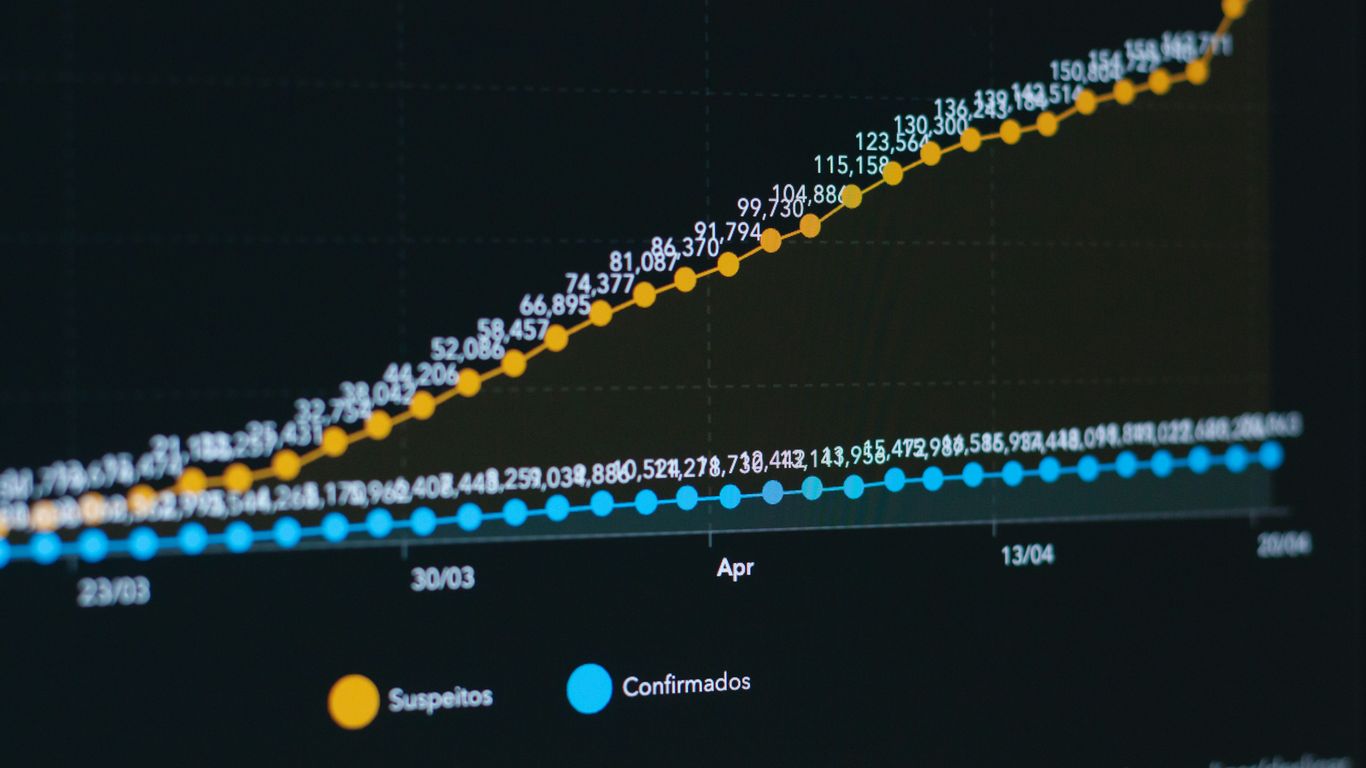

- The plan provides both guaranteed and non-guaranteed annual income, with projections showing different potential returns based on age.

- It can be funded with cash or Supplementary Retirement Scheme (SRS) funds, making it suitable for single premium planning.

- When compared to plans like NTUC Income GroRetire Wise and Singlife Steadypay Saver, AIA Retirement Saver II has specific features that might appeal to different needs.

- Consider your personal retirement goals, risk tolerance, and compare it with other available plans before deciding on AIA Retirement Saver II.

Understanding AIA Retirement Saver II

Planning for your retirement is a big step, and understanding the tools available to help you is key. The AIA Retirement Saver II is one such plan designed to help you build a nest egg for your later years. It aims to provide a steady stream of income or a lump sum when you stop working, giving you more control over your financial future. This plan is part of AIA’s suite of retirement solutions, and it’s worth looking into if you’re thinking about how to fund your post-work life. It’s important to remember that retirement planning is a long-term commitment, and understanding the specifics of any plan you consider is vital. You can find more general information about retirement planning in Singapore at Singapore Finance.

Key Features of AIA Retirement Saver II

The AIA Retirement Saver II is built with several features to help you save for retirement. It typically allows for regular premium payments over a set period, building up your savings over time. The plan aims to grow your capital, and upon reaching a specified retirement age, it can provide payouts. Some plans might offer a lump sum at maturity, while others focus on providing a regular income stream. It’s designed to be a straightforward way to save, and understanding its core mechanics is the first step. Many retirement annuity plans in Singapore offer customizable terms, and this plan is no different, allowing you to tailor it to your needs. You can explore various retirement annuity plans in Singapore to see how they compare here.

Payout Options and Durations

When you reach retirement age with the AIA Retirement Saver II, you’ll likely have choices regarding how you receive your money. These options often include receiving a lump sum payment, which can be useful for large expenses or reinvestment. Alternatively, many plans offer a regular income stream, paid out monthly, annually, or at other intervals. The duration of these payouts can also vary significantly. Some plans might offer payouts for a fixed term, such as 10, 15, or 20 years, while others might provide payouts for your entire lifetime. The choice you make here can greatly impact your retirement cash flow, so it’s important to consider how long you anticipate needing income and how much you might need each period. Planning your retirement cash flow can be made easier with tools that help you forecast your income. You can use a tool to help forecast your retirement cash flow here.

Suitability for Different Retirement Goals

The AIA Retirement Saver II can be suitable for a range of retirement goals, depending on your personal circumstances and objectives. If you prefer a straightforward savings approach with a guaranteed lump sum at the end of your savings period, this plan might fit. For those who want a predictable income stream to cover living expenses during retirement, the annuity payout options could be ideal. It’s also worth considering if you have specific financial targets, like leaving an inheritance or funding a particular lifestyle in retirement. The plan’s flexibility in terms of premium payment and payout options means it can be adapted to different life stages and financial plans. For instance, if you’re looking for a plan that provides a significant lump sum upon maturity, a plan like the AIA Smart Wealth Builder II might be relevant here.

It’s always a good idea to review your retirement plan periodically to ensure it still aligns with your life goals and financial situation. Life circumstances can change, and so can your retirement needs.

Comparing AIA Retirement Saver II with Other Plans

When you’re looking at retirement plans, it’s easy to get lost in all the options. AIA Retirement Saver II is one choice, but how does it stack up against others? Let’s break down a few popular alternatives to see how they compare. It’s important to remember that each plan has its own strengths and weaknesses, and what works for one person might not be the best fit for another. We’ll look at some key features and potential returns to help you get a clearer picture.

AIA Retirement Saver II vs. NTUC Income GroRetire Wise

When comparing retirement plans, it’s helpful to look at the specifics. AIA Retirement Saver II and NTUC Income GroRetire Wise both aim to provide a steady income stream during your retirement years. However, they might differ in their payout structures, premium payment flexibility, and any additional benefits they offer. For instance, one plan might offer a longer payout period, while another might have more attractive guaranteed returns. It’s a good idea to check the details of each to see which aligns better with your personal retirement vision. You might find that one plan offers a more straightforward approach, while another provides more options for customization.

AIA Retirement Saver II vs. Singlife Steadypay Saver

Singlife Steadypay Saver is another plan that often comes up in these comparisons. When you look at AIA Retirement Saver II versus Singlife Steadypay Saver, you’ll want to consider factors like the total premiums paid over the policy term, the projected maturity amounts, and any cash benefits that might be available along the way. Some plans might offer higher guaranteed amounts, which provides a certain level of certainty, while others might project higher returns but with more variability. It’s also worth noting if a plan allows for early cash withdrawals or offers flexibility in premium payments, as this can be important for managing your finances during the accumulation phase. Understanding these differences can help you make a more informed choice about where to put your savings.

Choosing the right retirement plan involves looking beyond just the headline figures. Consider the policy term, flexibility in payouts, and any additional benefits that might be important for your long-term financial security.

AIA Retirement Saver II vs. Manulife RetireReady Plus III

Manulife RetireReady Plus III is frequently highlighted for its comprehensive features, including strong disability coverage and flexible payout options. When you compare this with AIA Retirement Saver II, you’ll want to examine how each plan handles potential life events, such as disability or early retirement. Manulife’s plan, for example, is often noted for its built-in disability rider and options to adjust payout periods. AIA Retirement Saver II might offer a different set of benefits or a simpler structure. It’s about finding the plan that best matches your specific needs for security, flexibility, and potential growth. For those looking for a robust set of features, it’s worth exploring how these plans differ in their coverage and payout flexibility. You can find more information on various retirement plans available in Singapore to help with your decision-making process.

It’s a good idea to get quotes for each plan and really dig into the policy documents. What looks good on paper might have nuances that are important for your personal situation. Don’t hesitate to speak with a financial advisor who can help you understand the fine print and how each plan fits into your overall retirement strategy. Remember, the goal is to find a plan that provides you with the financial confidence you need for your later years.

Single Premium Retirement Planning with AIA

When you have a lump sum of money ready to go, a single premium retirement plan can be a smart move. It means your money starts working for you right away, without the worry of inflation eating away at its value. This approach can simplify your retirement savings strategy by consolidating your funds into one plan.

Benefits of Single Premium Plans

- Immediate Compounding: Your entire sum starts earning returns immediately, allowing compound interest to work its magic from day one.

- Simplified Management: Instead of managing multiple smaller contributions, you manage one larger investment, which can be less time-consuming.

- Potential for Higher Returns: Depending on the plan, a larger initial sum might qualify for better rates or investment options compared to smaller, staggered contributions.

Using Cash and SRS for AIA Retirement Saver II

With AIA Retirement Saver II, you have the flexibility to fund your plan using either cash or your Supplementary Retirement Scheme (SRS) funds. Using SRS funds can be particularly attractive as it offers tax relief in the year you contribute, effectively reducing your taxable income. This can be a significant advantage for those looking to optimize their tax situation while planning for retirement. It’s worth exploring how your SRS savings can be best utilized for long-term financial goals like retirement. You can find more information on financial planning tools at Singapore Finance.

Break-Even Points and Compounding Interest

Understanding the break-even point of your single premium plan is important. This is the point in time when the total returns from your investment equal your initial premium. Compounding interest plays a key role here; the longer your money is invested, the more significant the impact of compounding becomes. For instance, a plan with a guaranteed annual income might have a different break-even point than one focused on capital growth. It’s about letting your money grow on itself over time.

It’s always a good idea to look at the projected returns and understand how long it might take for your initial investment to grow, especially when considering different payout options and durations. This helps in setting realistic expectations for your retirement income stream.

AIA Retirement Saver II Payout Scenarios

When you’re planning for retirement, it’s helpful to see how different payout options might work for you. AIA Retirement Saver II offers flexibility in how you receive your money, and understanding these scenarios can help you make a more informed choice about your future income stream. Let’s look at a couple of common payout durations.

15 Years Payout from Age 65

Choosing a 15-year payout starting at age 65 means you’ll receive regular income for a significant portion of your retirement. This option provides a structured way to manage your funds, ensuring a consistent income for a defined period. It’s a popular choice for those who want a clear end date for their retirement income, allowing for focused financial planning during those years.

20 Years Payout from Age 65

Opting for a 20-year payout from age 65 extends the period of regular income. This can be beneficial if you anticipate higher expenses later in retirement or simply prefer a longer duration of guaranteed income. It offers a greater sense of security, knowing that your income stream will continue for a longer stretch, potentially covering more of your retirement years. This flexibility is a key aspect of planning for long-term financial security.

Guaranteed vs. Non-Guaranteed Income

It’s important to distinguish between the guaranteed and non-guaranteed components of your retirement income. The guaranteed portion provides a baseline income that you can rely on, regardless of market performance. The non-guaranteed portion, often referred to as bonuses or dividends, can increase your total payout but is subject to the performance of the insurer’s participating fund. While these bonuses can enhance your returns, they are not assured. Understanding this difference is key to setting realistic expectations for your retirement income.

The interplay between guaranteed and non-guaranteed payouts is a critical factor in retirement planning. While guaranteed income offers stability, non-guaranteed bonuses can provide an upside, but it’s wise to plan based on the guaranteed amounts to avoid potential shortfalls.

Here’s a general idea of how payouts might look, though specific figures will depend on your policy details and the insurer’s performance:

| Payout Duration | Age 65 Payout (Guaranteed) | Age 65 Payout (Projected) |

|---|---|---|

| 15 Years | [Example Amount A] | [Example Amount B] |

| 20 Years | [Example Amount C] | [Example Amount D] |

Note: Example amounts are illustrative and will vary based on individual policy terms and prevailing market conditions.

Evaluating AIA Retirement Saver II’s Benefits

When you’re looking at a plan like AIA Retirement Saver II, it’s smart to break down what it actually offers. It’s not just about the future payout; it’s about understanding the different ways your money can work for you and what guarantees are in place. This helps you see if it really fits what you’re trying to achieve for your retirement.

Lump Sum at Maturity

One of the ways to get your money back is as a lump sum when the policy term ends. This is a straightforward option if you prefer to have a single large amount to manage. It’s important to know the exact amount you’re guaranteed to receive versus any projected amounts, which depend on how the insurer’s investments perform. For example, some plans might offer a guaranteed amount that’s lower than projected figures, so checking those details is key. You can compare these figures with other plans to get a clearer picture of potential returns.

Guaranteed Annual Income

Many people find a guaranteed stream of income very reassuring for retirement. AIA Retirement Saver II typically offers a guaranteed annual payout. This means you know exactly how much you’ll receive each year, regardless of market fluctuations. This predictable income can be a solid foundation for your retirement budget. It’s a significant benefit because it removes a layer of uncertainty about your future income.

Non-Guaranteed Annual Income Projections

Beyond the guaranteed income, there are often projected non-guaranteed amounts. These projections are usually based on historical performance and expected future returns, often at a certain interest rate, like 4.75%. While these projections can show a higher potential payout, it’s crucial to remember they aren’t guaranteed. They give you an idea of what might be possible, but your actual returns could be higher or lower. It’s wise to look at these projections as a potential upside rather than a certainty when planning your retirement finances. You can use tools to help estimate your needs, like a retirement income planner.

Understanding both the guaranteed and projected figures is vital. It allows for a balanced view of the plan’s potential benefits and risks, helping you make a decision that aligns with your financial comfort level and retirement objectives.

Making an Informed Decision on AIA Retirement Saver II

Deciding on a retirement plan is a big step, and it’s smart to look at all the angles before you commit. The AIA Retirement Saver II is one option, but how does it really stack up for your personal situation? It’s not just about the numbers; it’s about whether the plan’s features align with what you want your retirement to look like. Think about your comfort level with risk, how much income you’ll need, and when you plan to stop working. These personal factors are just as important as the plan’s guaranteed payouts or potential bonuses.

Factors to Consider Before Committing

Before you sign on the dotted line, take a moment to really think about a few key things. It’s easy to get caught up in the excitement of planning for the future, but a little bit of careful consideration now can save a lot of headaches later. You want to make sure the plan you choose actually fits your life, not the other way around.

- Your Retirement Age: When do you actually want to stop working? Some plans have fixed retirement ages, while others offer more flexibility. AIA Retirement Saver II allows you to choose retirement ages like 50, 55, 60, 65, and 70, which is pretty good. But what if you want to retire at 58? That’s something to check.

- Payout Duration: How long do you want to receive income? AIA Retirement Saver II offers payout periods of 15 and 20 years. If you’re looking for income that lasts your entire retirement, you might need to consider other options or supplement this plan.

- Guaranteed vs. Non-Guaranteed Income: The plan provides a guaranteed amount each year, which is great for certainty. But it also projects non-guaranteed income, which can be higher but isn’t a sure thing. It’s important to base your retirement budget on the guaranteed portion and view the non-guaranteed part as a potential bonus.

- Flexibility: Life happens. Can you adjust your plan if your circumstances change? For example, what if you need to access your funds early, or if your income needs change? Understanding the plan’s flexibility, or lack thereof, is key.

- Fees and Charges: Like most financial products, there are usually fees involved. Make sure you understand what these are and how they might impact your overall returns. Sometimes these are built into the policy illustration, but it’s good to ask for a clear breakdown.

When AIA Retirement Saver II Might Be Suitable

This plan could be a good fit if you’re looking for a straightforward way to get a regular income stream during your retirement years, and you appreciate having a guaranteed amount you can count on. If you prefer a plan that offers a potential lump sum at maturity on top of your regular income, AIA Retirement Saver II has that feature, which is a nice bonus. It’s also a solid choice if you’re comfortable with the payout durations offered and your retirement timeline aligns with the available retirement ages. For those who like the idea of a plan that combines guaranteed income with the possibility of extra returns, this plan presents a balanced approach. It’s also worth noting that single premium plans, like this one can be, often have a faster break-even point because the insurer receives the full sum at the start, allowing interest to compound more quickly compared to plans with longer premium payment terms. This can be an attractive feature if you’re looking to maximize the growth of your savings over time. If you’re interested in using your Supplementary Retirement Scheme (SRS) funds for retirement planning, AIA Retirement Saver II is an option that can accommodate this, potentially offering tax advantages. You can explore how different payout scenarios might work for you, like receiving income for 15 or 20 years from age 65, to see if it matches your expected retirement lifestyle. For a clearer picture, comparing it with other plans like the NTUC Income GroRetire Wise or Singlife Steadypay Saver can help you see where AIA Retirement Saver II stands in terms of its benefits and payout structures. You might also find it helpful to look at customer reviews for AIA insurance policies to get a sense of other people’s experiences. For instance, if you’re comparing it to something like the Tata AIA Smart Pension Scheme, you’d want to see how the features and projected returns differ.

Alternatives for Retirement Savings

It’s always a good idea to know what other options are out there. While AIA Retirement Saver II is one product, the world of retirement planning is quite broad. You might find that other plans better suit your specific needs or risk tolerance. For example, some people prefer investment-linked policies (ILPs) that offer more potential for growth, though they also come with market risk. Plans like the AIA Pro Lifetime Protector (II) are investment-linked and aim to grow wealth alongside protection. Other insurers offer plans with different payout structures, such as lifetime payouts, which AIA Retirement Saver II does not provide. You could also look into endowment plans that focus on capital protection and guaranteed maturity benefits, or even consider pure investment vehicles if you have a higher risk appetite and a longer time horizon. For instance, the Tata AIA Life Whole Life Income Fund II is a debt fund focused on capital growth. It’s also important to remember that CPF LIFE is a foundational retirement income source in Singapore, and private plans often serve to supplement it. Understanding how these alternatives compare, perhaps by looking at customer reviews for various AIA insurance policies [12d1], can help you make a more informed choice. Ultimately, the best retirement savings strategy is the one that aligns with your personal financial goals and comfort level.

Deciding on the right retirement plan can feel tricky, but understanding your choices makes it easier. The AIA Retirement Saver II offers specific benefits that might be a great fit for your future. Want to learn more about how it works and if it’s the best option for you? Visit our website today for clear explanations and helpful tools to guide your decision.

Wrapping Up Your Retirement Savings Plan

Thinking about retirement savings can feel like a big task, but breaking it down makes it more manageable. We’ve looked at how plans like the AIA Retirement Saver can help build up your funds over time. It’s about finding a strategy that fits your personal financial situation and your goals for when you stop working. Remember, starting early, even with small amounts, can make a significant difference down the road. Consider what kind of income stream you’d prefer and how long you want it to last. Taking the time to compare options and understand the details is key to making a choice you’ll be comfortable with for years to come.

Frequently Asked Questions

What is the AIA Retirement Saver II plan?

The AIA Retirement Saver II is a plan designed to help you save money for your retirement. It’s like a special savings account that grows your money over time and then pays you a regular income when you stop working.

How does the AIA Retirement Saver II pay out money?

You can choose how long you want to receive your retirement income. For example, you can get paid for 15 years or 20 years, starting when you reach a certain age, like 65. The plan also might give you a lump sum of money when the savings period ends.

Can I use my CPF or SRS money for this plan?

Yes, you can often use money from your Supplementary Retirement Scheme (SRS) account to pay for this plan. This can be a smart way to save for retirement and potentially get tax benefits.

What’s the difference between guaranteed and non-guaranteed income from this plan?

Guaranteed income is the amount of money you are sure to receive. Non-guaranteed income is extra money that the insurance company might pay you, based on how well their investments do. It could be more, or it could be less.

Is AIA Retirement Saver II good for everyone?

This plan is best if you want a steady income during retirement and like the idea of a lump sum at the end. It’s important to compare it with other plans to see if it fits your personal retirement goals and how much you can afford to save.

What happens if I need my money before retirement?

Generally, retirement plans are meant for long-term savings. Taking money out early might mean you get less than you put in, or you might not be able to take it out at all until your chosen retirement age. It’s best to check the specific terms of the plan.