Thinking about your health insurance options? You’ve probably heard about MediShield Life, but did you know you can get more coverage? That’s where Integrated Shield Plans (IPs) come in, and NTUC Income’s Enhanced IncomeShield is a popular choice. We’re doing a NTUC Income Enhanced IncomeShield Review [2025] to help you figure out if it’s the right fit for you. It’s all about understanding what you’re getting and how it fits with your basic coverage.

Key Takeaways

- NTUC Income Enhanced IncomeShield works alongside MediShield Life to give you better hospital and medical coverage.

- It lets you choose higher ward classes in public hospitals or even private hospitals.

- You can use your MediSave account to pay for most of the premiums.

- Adding a rider, like the Classic Care Rider, can help lower your out-of-pocket costs.

- It’s smart to compare different plans to find the best value for your needs.

Understanding Enhanced IncomeShield

What is Enhanced IncomeShield?

Enhanced IncomeShield is an integrated shield plan offered by NTUC Income, a well-known insurance provider in Singapore. It’s designed to work alongside your existing MediShield Life coverage, providing an extra layer of protection for hospitalisation and medical treatments. Think of it as an upgrade to the basic coverage that MediShield Life offers. This type of plan, known as an integrated shield plan, is a popular choice for many Singapore residents looking for more robust health insurance. It’s a way to manage potential medical expenses, which can be quite high due to medical inflation. Many people opt for these plans to get access to better ward classes, more choice in doctors, and extended pre- and post-hospitalisation coverage beyond what MediShield Life provides. It’s important to know that you can only be insured with one insurer for an integrated shield plan, so choosing the right one is key. If you’re considering upgrading your coverage, it’s a good idea to understand how these plans fit into the broader healthcare financing landscape in Singapore. You can check your current MediShield Life and integrated shield plan status through the CPF website using your SingPass.

Key Benefits of Enhanced IncomeShield

Enhanced IncomeShield from NTUC Income offers several advantages for those seeking more comprehensive health coverage. One of the main draws is its ability to provide coverage for treatments at various hospital types, including private hospitals, and often on an ‘as charged’ basis, subject to policy terms. This means you have more flexibility in choosing where you receive care. The plan also typically includes benefits for pre-hospitalisation treatment, covering expenses incurred before you’re admitted to the hospital, and post-hospitalisation treatment, which can extend for a significant period after you’re discharged. This dual coverage helps manage the costs associated with recovery. Additionally, it can cover specific outpatient treatments like chemotherapy and renal dialysis, which are often significant expenses. For families, NTUC Income has a budget-friendly option that can be suitable for groups like SMEs, offering the convenience of cashless claims at a wide network of clinics. The ability to use your MediSave account for premium payments makes it more accessible for many.

How Enhanced IncomeShield Complements MediShield Life

MediShield Life is the foundational health insurance scheme in Singapore, providing basic coverage for all citizens and permanent residents. However, it has certain limitations, such as claim limits and coverage primarily for Class B2/C wards in public hospitals. This is where an integrated shield plan like Enhanced IncomeShield comes into play. It integrates with your MediShield Life coverage, meaning your premiums for MediShield Life are often handled by the integrated shield plan provider, acting as a single point of contact. Enhanced IncomeShield then adds on benefits that go beyond the basic MediShield Life coverage. This can include:

- Higher Ward Classes: Access to Class A wards in public hospitals or private hospital rooms.

- Extended Coverage: Longer periods for pre- and post-hospitalisation treatments.

- Choice of Doctors: More flexibility in selecting your treating physician.

- As Charged Basis: Coverage for medical expenses as they are incurred, up to policy limits.

- Rider Options: The possibility to add riders for further coverage on deductibles and co-insurance, which are out-of-pocket expenses you might still have to pay with just the basic plan.

By combining Enhanced IncomeShield with MediShield Life, you create a more robust safety net for your healthcare needs, offering greater peace of mind against potentially high medical bills. It’s a way to tailor your health insurance to your specific needs and preferences, going beyond the standard provisions. If you’re looking to understand your insurance needs better, tools are available to help estimate them based on your personal circumstances in Singapore. Estimate your needs.

Coverage Details and Benefits

This section breaks down what your Enhanced IncomeShield plan actually covers, looking at hospital stays, treatments before and after you’re admitted, and even outpatient care. It’s important to know the specifics of your health insurance so you can make the most of it when you need it.

Hospitalisation and Medical Treatment Coverage

Enhanced IncomeShield is designed to help with the costs associated with being admitted to a hospital. It covers various medical treatments and procedures you might need during your stay. This includes things like surgical procedures, intensive care unit (ICU) stays, and treatments for specific conditions like cancer or kidney dialysis. The plan aims to cover expenses as charged, meaning it generally doesn’t have a fixed cap on treatment costs, allowing for flexibility depending on the medical services required. This is a key aspect of why people choose an Integrated Shield Plan over basic coverage, as it provides a higher level of financial support for medical needs.

Pre and Post-Hospitalisation Benefits

Your medical journey doesn’t end when you leave the hospital. Enhanced IncomeShield provides coverage for medical treatments and consultations that happen before you’re admitted and after you’re discharged. This can include diagnostic tests, follow-up appointments, and rehabilitation therapies. Typically, this coverage extends for a period of up to 180 days before hospitalisation and up to 365 days after discharge. This helps ensure that your recovery process is supported without adding significant financial strain.

Outpatient Treatment Coverage

Beyond hospital stays, Enhanced IncomeShield also offers benefits for certain outpatient treatments. This can be particularly helpful for ongoing medical needs that don’t require an overnight stay. For instance, it can cover treatments like chemotherapy for cancer and renal dialysis for kidney conditions. These are often significant medical expenses that can be managed more effectively with the support of your health insurance plan. It’s worth checking the specific details of your plan to see the full extent of outpatient coverage available.

Understanding the specifics of your hospitalisation, pre- and post-hospitalisation, and outpatient benefits is key to making informed decisions about your healthcare. This type of health insurance is designed to work alongside your existing government-provided coverage, offering an additional layer of financial security.

Here’s a general overview of what might be covered:

- Inpatient Hospital Treatment: Covers costs during your hospital stay.

- Pre-Hospitalisation: Medical expenses incurred before admission (e.g., tests, consultations).

- Post-Hospitalisation: Medical expenses after discharge (e.g., follow-ups, therapy).

- Outpatient Treatments: Specific treatments like chemotherapy or dialysis.

- Emergency Overseas Treatment: Coverage for urgent medical needs while abroad.

It’s always a good idea to review your policy documents or speak with a representative to confirm the exact coverage details applicable to your specific situation. This ensures you know what to expect when you need to make a claim, providing peace of mind for your health insurance needs.

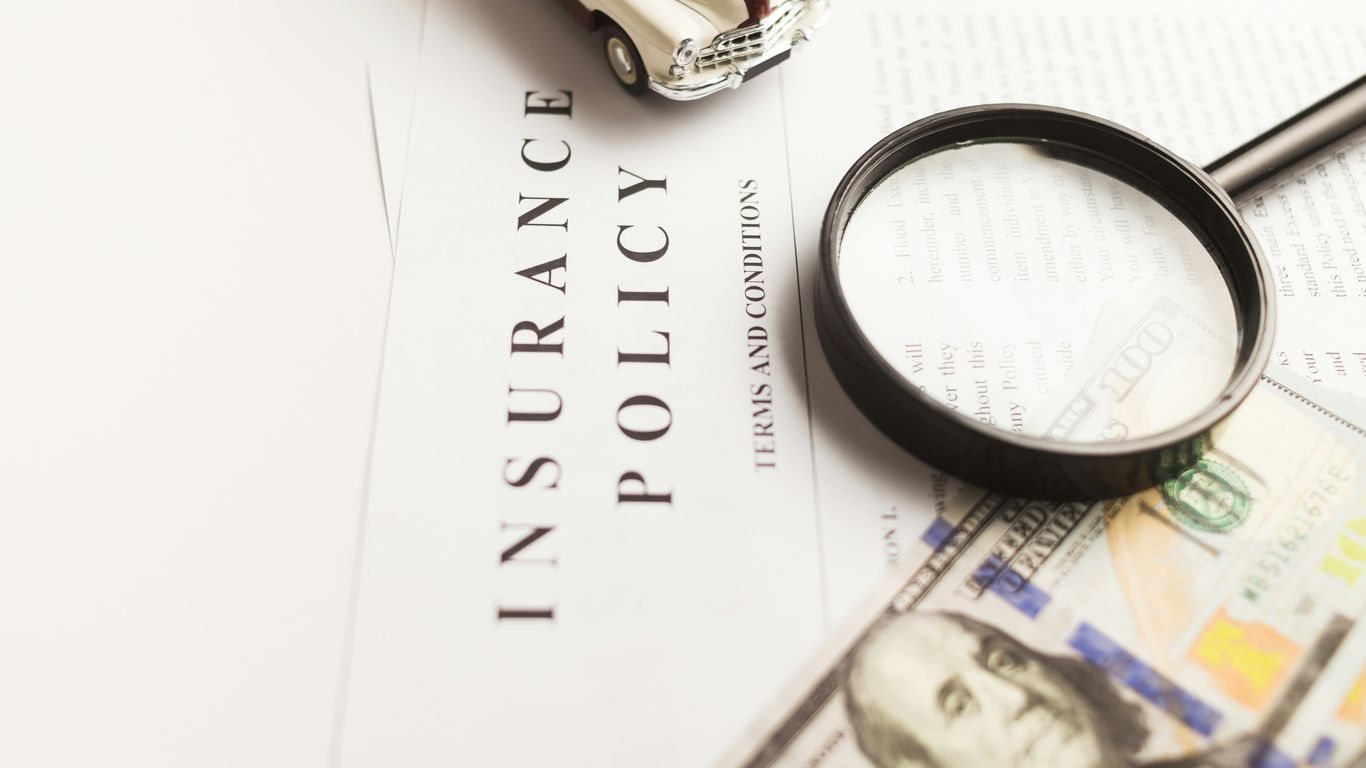

Riders and Additional Benefits

Understanding Integrated Shield Plan Riders

Integrated Shield Plans (IPs) offer a solid foundation for your medical coverage, but they often come with deductibles and co-insurance amounts. This is where riders come into play. Riders are optional add-ons that can significantly reduce your out-of-pocket expenses by covering these deductibles and co-insurance payments. Think of them as a way to fine-tune your plan for maximum financial protection. It’s important to remember that rider premiums are typically paid with cash, not MediSave, and they usually increase as you get older. When looking at riders, you’ll find a variety of options designed to complement your main IP, such as those that cover critical illnesses or provide additional daily hospital cash benefits. For instance, some riders can cover co-insurance down to 5%, often with an annual cap, which can make a big difference in your total medical bill.

The Role of Classic Care Rider

The Classic Care Rider is a specific type of rider that offers a more budget-friendly approach to reducing your out-of-pocket medical expenses. While it might not offer the same level of comprehensive coverage as some other riders, it can still be a sensible choice for those looking for basic protection against deductibles and co-insurance. It’s designed to be more affordable, making it accessible to a wider range of policyholders. However, it’s worth noting that plans with a Classic Care Rider might still involve a co-payment, typically around 10% of the benefits, so it’s good to understand the exact terms. This option can be particularly appealing if you’re trying to manage your overall insurance costs while still getting some help with those unexpected medical bills.

Reducing Out-of-Pocket Expenses with Riders

One of the primary reasons people opt for riders is to minimize the amount they have to pay themselves when they need medical treatment. Without a rider, you’d be responsible for the deductible (a fixed amount you pay first) and co-insurance (a percentage of the remaining bill). Riders can effectively eliminate or significantly reduce these costs. For example, a rider might cover the deductible entirely, or it might cap your co-insurance payment at a certain amount per year. This can be a huge relief, especially when facing major medical procedures or extended hospital stays. Comparing different riders is key to finding one that fits your needs and budget, ensuring you’re well-protected without overspending. For example, comparing plans from providers like NTUC Income can help you see the differences in rider benefits and costs. It’s always a good idea to get a clear picture of what each rider covers and how it impacts your potential out-of-pocket spending. You can explore options for car insurance riders as well, which serve a similar purpose of adding specific protections to your base policy like no-claim discount protectors.

Here’s a general idea of how deductibles and co-insurance work, and how riders help:

| Expense Type | Without Rider (Example) | With Rider (Example) |

|—————–|————————-|

| Medical Bill | $10,000 | $10,000 |

| Deductible | $3,500 | $0 |

| Co-insurance (10%)| $650 | $0 |

| Total Out-of-Pocket | $4,150 | $0 |

Note: This is a simplified example. Actual amounts vary by plan and rider.

Premium and Payment Options

When it comes to paying for your Enhanced IncomeShield, you’ve got a few ways to handle it. Understanding these options can help you manage your budget effectively. Most people find that using their MediSave account is the most convenient method, and it’s a common practice for these types of plans.

MediSave Account Utilisation for Premiums

Your MediSave account can be used to pay for your Enhanced IncomeShield premiums. This is a big plus because it means you don’t necessarily need to come up with cash out of pocket for the regular payments. The government also offers subsidies to help make these premiums more affordable, which is good news for many policyholders. It’s worth checking out the specifics of how much you can use from your MediSave, as there are limits, but generally, it covers a significant portion of the cost. You can find more details on how MediShield Life premiums are paid using MediSave on the government’s health insurance website. MediShield Life premiums can be fully paid.

Factors Influencing Premium Costs

Several things can affect how much you’ll pay for your Enhanced IncomeShield. Your age at the time of application is a major factor; generally, the younger you are, the lower your premiums will be. The type of plan and any riders you choose also play a role. For instance, opting for a plan that covers private hospital stays will typically cost more than one that covers only public hospital wards. The specific benefits and coverage levels you select directly impact the premium amount. It’s also worth noting that premiums can increase as you get older, which is a standard practice in the insurance industry.

Lifetime Premium Considerations

Thinking about the long term is important when choosing any insurance plan. With Enhanced IncomeShield, you’ll want to consider the total cost over your lifetime. Some plans offer different premium payment terms, allowing you to pay for your coverage over a set period, like 10, 20, or 25 years, or even up to a certain age. This flexibility can help manage your cash flow. It’s also useful to look at how premiums might change over time, especially as you age or if you make claims. Understanding these lifetime costs helps you make a more informed decision about the plan’s overall value and affordability for your future.

It’s always a good idea to compare different plans and their premium structures to find the best fit for your financial situation and health needs. Don’t hesitate to ask your insurer or a financial advisor for a clear breakdown of all costs involved.

Comparing Enhanced IncomeShield

When you’re looking at health insurance, it’s easy to get lost in all the options. Enhanced IncomeShield is one of many Integrated Shield Plans (IPs) available, and understanding how it stacks up against others is important. It’s not just about the name; it’s about what fits your needs and your budget best. We’ll break down some key comparison points to help you make a more informed choice.

Enhanced IncomeShield vs. Other Integrated Shield Plans

Different insurance providers offer their own versions of Integrated Shield Plans, and they all have their unique features and pricing. For instance, some plans might offer longer pre- and post-hospitalisation coverage periods, while others might have broader outpatient benefits. Income Enhanced IncomeShield Preferred is often noted for its affordability, especially when paired with the Classic Care Rider, making it a cost-effective choice for many. However, other plans might offer higher annual coverage limits or unique benefits like coverage for specific outpatient treatments that Income’s plan might not include. It’s a good idea to look at a few options side-by-side to see the differences.

Here’s a general look at how some plans compare in terms of premiums for private hospital coverage, though remember these can change:

| Age Next Birthday | Income Enhanced IncomeShield Preferred | AIA HealthShield Gold Max A | Raffles Shield Private |

|---|---|---|---|

| 21 – 30 | $468 – $471 | $337 | $500 – $573 |

| 31 – 40 | $729 – $732 | $482 | $782 – $827 |

| 41 – 50 | $1062 – $1157 | $799 | $1511 – $1595 |

Affordability and Value Proposition

When we talk about affordability, Income’s Enhanced IncomeShield, particularly with the Classic Care Rider, often comes out as a strong contender. It’s known for having competitive premiums, which means you get a good amount of coverage without breaking the bank. This plan is designed to cover the essentials of hospitalization and medical expenses. The value proposition here is getting solid protection at a price that’s generally lower than many other similar plans. It’s a practical choice if you’re looking to manage your expenses while still having good medical coverage. Remember, buying insurance when you’re younger and healthier usually means lower premiums, so it’s worth considering early on purchasing health insurance.

Assessing Plan Suitability

Deciding which plan is best for you really comes down to your personal circumstances and what you prioritize. If your main goal is to keep costs down while still getting decent coverage, Income Enhanced IncomeShield is definitely worth a close look. On the other hand, if you need very specific benefits, like extensive outpatient coverage for certain conditions or longer pre- and post-hospitalisation periods, you might want to explore other options. For example, AIA offers a longer pre- and post-hospitalisation period, and HSBC Life Shield is noted for its attractive premiums and straightforward rider structure. It’s also important to consider how the plan complements MediShield Life, as all Integrated Shield Plans do, but the specifics can vary. Ultimately, the

Navigating Claims and Policy Changes

Dealing with insurance claims and understanding how your policy might change over time is a big part of having health coverage. It’s not always straightforward, and knowing what to expect can save you a lot of hassle. Let’s break down some common issues and what you need to keep in mind.

Common Reasons for Claim Rejection

It’s frustrating when a claim gets denied, but often there are clear reasons why. Understanding these can help you avoid them in the future. Some common pitfalls include:

- Not getting pre-approval: For certain procedures or treatments, your insurer might require approval before you undergo them. Skipping this step can lead to a rejected claim.

- Exclusions in your policy: Every insurance plan has a list of what it doesn’t cover. This could be specific treatments, pre-existing conditions that weren’t declared, or experimental therapies.

- Incomplete or incorrect information: When you submit a claim, make sure all the details are accurate and all required documents are included. Missing information or errors can cause delays or outright rejection.

- Exceeding policy limits: Your plan will have limits on how much it will pay out for certain services or over a policy year. If your claim goes beyond these limits, the excess amount won’t be covered.

It’s always a good idea to review your policy documents carefully and speak with your insurance provider or financial advisor if you’re unsure about what’s covered before you receive treatment. This proactive approach can prevent many common claim issues.

Switching Integrated Shield Plan Providers

Thinking about switching to a different Integrated Shield Plan (IP) provider? It’s possible, but there are some important things to consider. The biggest hurdle is usually pre-existing medical conditions. If you have any health issues that were diagnosed before you apply for a new plan, the new insurer might exclude coverage for those conditions, or even reject your application altogether, especially for riders. You’ll also need to go through the underwriting process again, which means your premiums could be higher based on your current age and health status. It’s a decision that requires careful thought and comparison.

Here’s a quick look at what happens when you switch:

- Underwriting: You’ll likely need to undergo medical underwriting again.

- Pre-existing conditions: Coverage for these might be excluded or lead to rejection.

- Premiums: Your new premium will be based on your current age and health.

- Waiting periods: New waiting periods might apply for certain conditions.

If you’re considering a change, it’s wise to compare plans thoroughly and understand the implications for your specific health situation. You can compare insurance options to find a plan that better suits your needs.

Understanding Policy Renewal and Changes

Your insurance policy isn’t static. Insurers periodically review their plans, and this can lead to changes in premiums or benefits. For instance, Income’s Integrated Shield Plan and riders are set to see premium adjustments in October 2025, with an average increase of about 4.5%. These changes are often based on factors like claims experience, healthcare cost inflation, and regulatory updates. It’s important to stay informed about these potential shifts. When your policy renews, you’ll receive updated information, and it’s your responsibility to review it to ensure your coverage still meets your needs. If you’re unhappy with the changes or find a better deal elsewhere, you can explore options like comparing insurance quotes, but remember the points about switching providers mentioned earlier. Being aware of these updates helps you manage your health insurance effectively.

Dealing with insurance claims and changes to your policy can be tricky. We’re here to make it easier to understand. If you need help figuring out your options or have questions about your coverage, visit our website for clear explanations and support.

Wrapping Up Your Integrated Shield Plan Choice

So, after looking at all the options, it’s pretty clear that picking the right Integrated Shield Plan (ISP) is a big deal. These plans really do offer a step up from just MediShield Life, giving you more choices for hospital stays and treatments. Remember, the premiums can change as you get older, and switching plans later on can be a hassle, especially if you have existing health issues. It’s best to do your homework now, compare what each insurer offers, and pick a plan that fits your needs. Think about what kind of hospital ward you prefer, how much coverage you really need, and what you can afford. Getting this right now means fewer worries down the road.

Frequently Asked Questions

What exactly is Enhanced IncomeShield?

Enhanced IncomeShield is a type of health insurance that works alongside your basic MediShield Life plan. Think of it as an upgrade that gives you better coverage for hospital stays and medical treatments, often allowing you to stay in better-equipped hospital wards or private hospitals.

How is Enhanced IncomeShield different from MediShield Life?

MediShield Life provides a basic safety net for everyone in Singapore. Enhanced IncomeShield takes that a step further. It offers more benefits, like covering higher ward classes in public hospitals or even private hospital stays, and often includes extra help with costs before and after you’re admitted to the hospital.

Can I use my MediSave to pay for Enhanced IncomeShield premiums?

Yes, you can use your MediSave account to pay for a large part of the premiums for Enhanced IncomeShield. This makes it more affordable because you’re using money you’ve already set aside for healthcare.

What are riders, and do I need one with Enhanced IncomeShield?

Riders are optional add-ons that give you even more coverage. For example, a rider can help lower the amount you have to pay out-of-pocket for things like deductibles (the initial amount you pay) and co-insurance (a percentage of the bill). Whether you need one depends on how much extra protection you want.

What happens if I have a pre-existing medical condition?

Having a pre-existing medical condition can make it trickier to get certain types of insurance or riders. Insurers might charge you more, put limits on your coverage, or even exclude certain treatments. It’s best to talk to a financial advisor to see what options are available for you.

Is it possible to switch to Enhanced IncomeShield from another plan?

Switching plans is possible, but it’s not always simple. You’ll likely have to go through the application process again, and your premiums might change based on your age and health. Also, you could lose coverage for any existing medical issues if the new plan doesn’t cover them. It’s important to compare plans carefully before deciding to switch.