Running a business with a fleet of vehicles means you’ve got a lot on your plate. Keeping those cars on the road and your business moving forward is key. That’s where commercial car insurance comes in. It’s not just about following the rules; it’s about protecting your business from unexpected costs. Think of it as a safety net for your vehicles and your operations. We’ll break down what you need to know about commercial car insurance so you can make sure your fleet is properly covered.

Key Takeaways

- Commercial car insurance is a must-have for businesses that use vehicles for work. It protects your business financially if something happens on the road.

- Key coverage includes liability (for damage to others), physical damage (for your own vehicles), and uninsured/underinsured motorist protection.

- Your insurance costs depend on things like the types of vehicles you use, how you use them, your drivers’ records, and where your business operates.

- To get the best policy, figure out what your business really needs, compare prices from different companies, and always read the fine print to know what’s covered and what’s not.

- Keep your commercial car insurance up-to-date by reviewing your policy regularly, understanding how to file claims, and looking for ways to save money without skimping on protection.

Understanding Commercial Car Insurance

Commercial car insurance is a specific type of protection designed for vehicles used for business purposes. Unlike personal auto insurance, which covers your car for everyday driving and errands, commercial policies are built to handle the increased risks associated with business operations. This means if your company relies on vehicles for deliveries, client visits, transporting goods, or any other work-related activity, you’ll need this specialized coverage.

It’s not just about protecting your vehicles; it’s about safeguarding your entire business from potential financial fallout due to accidents or incidents involving your fleet. Think of it as a necessary investment to keep your operations running smoothly and securely. Without it, a single accident could lead to significant repair costs, medical bills, and legal expenses that could seriously impact your bottom line.

What is Commercial Car Insurance?

Commercial car insurance, sometimes called business auto insurance, is a policy that covers vehicles used for work. If you use your car for business, even just part-time, your personal auto insurance might not cover you. This is where commercial coverage comes in. It’s designed to protect businesses that use vehicles for their operations, whether it’s a single car or a large fleet. This type of insurance is essential if you regularly use your personal vehicle for work-related activities, ensuring that your business is financially safeguarded against potential accidents and liabilities. It provides financial protection against damages to vehicles used for business purposes, covering things like accidents, theft, or vandalism. This coverage is vital for any business that depends on vehicles to function, offering a safety net against unexpected costs.

Key Components of Commercial Car Insurance

Commercial car insurance policies are typically made up of several key coverage types, each addressing different potential risks. Understanding these components will help you choose the right policy for your business fleet.

- Liability Coverage: This is usually the most important part of any commercial auto policy. It covers damages or injuries you cause to other people or their property in an accident. This includes bodily injury liability, which pays for medical expenses, lost wages, and pain and suffering for those injured, and property damage liability, which covers the cost to repair or replace other people’s property damaged in an accident.

- Physical Damage Coverage: This covers damage to your own business vehicles. It typically includes:

- Collision Coverage: Pays for damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters like hail or floods.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It can help pay for your medical bills, lost wages, and vehicle repairs.

It’s important to remember that the specific coverages and their limits can vary significantly between policies. Always read your policy documents carefully to understand exactly what is covered and what is not.

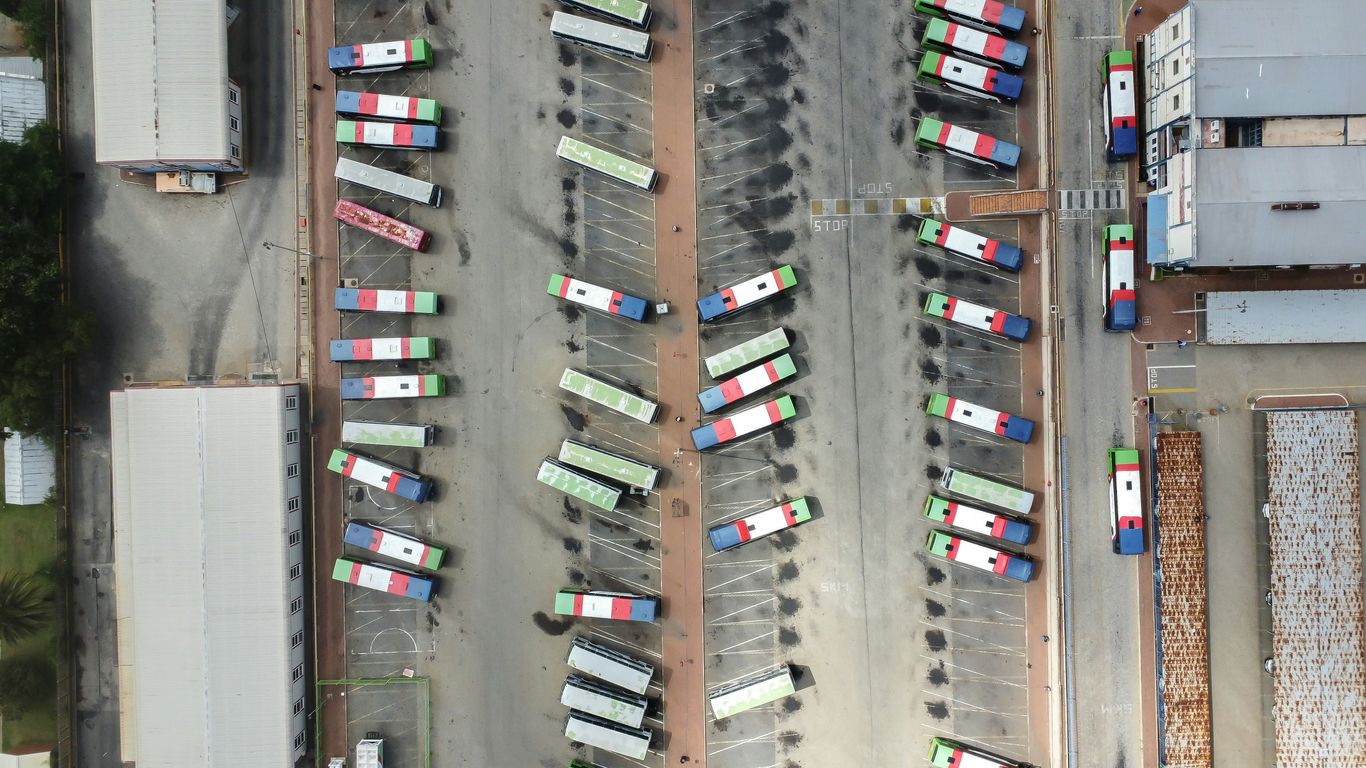

Choosing the right combination of these coverages, tailored to your business’s specific needs and risks, is key to effective fleet management. For instance, a business with a large fleet might look into commercial fleet insurance, which is specifically designed to protect your business from financial losses due to vehicle accidents, damage, or liability claims for multiple vehicles. This ensures your company is financially secure in case of incidents. You can compare quotes from multiple insurers to find the most suitable and cost-effective option for your business. Comparing quotes is a smart move.

Essential Coverage Options for Your Fleet

When you’re running a business with a fleet of vehicles, having the right insurance is a big deal. It’s not just about following the rules; it’s about protecting your business from unexpected costs. Let’s break down the main types of coverage you’ll want to look at.

Liability Protection

This is probably the most important part of your commercial auto policy. Liability coverage is split into two parts: bodily injury and property damage. If one of your drivers causes an accident, this coverage helps pay for the other person’s medical bills, lost wages, and damage to their car or property. It’s designed to protect your business from expensive lawsuits and claims. Without enough liability coverage, a serious accident could really hurt your company financially.

- Bodily Injury Liability: Covers medical expenses, lost income, and pain and suffering for people injured in an accident you caused.

- Property Damage Liability: Covers the cost to repair or replace property damaged in an accident you caused, like other vehicles, buildings, or fences.

Physical Damage Coverage

Physical damage coverage helps pay for repairs to your own business vehicles. There are two main types:

- Collision Coverage: This pays for damage to your vehicle resulting from a collision with another object, like a car, a pole, or a guardrail, or if your vehicle overturns. It typically has a deductible, which is the amount you pay out-of-pocket before the insurance kicks in.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions. Think theft, vandalism, fire, falling objects, or natural disasters like hail or floods. Like collision, it usually comes with a deductible.

Uninsured/Underinsured Motorist Coverage

This coverage is for when you’re in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s a good idea to have this because you can’t always count on other drivers being properly insured. It can help pay for your medical bills and, in some cases, damage to your vehicle if the at-fault driver can’t cover it.

It’s important to understand that the specific coverages and their limits can vary significantly between policies. Always read the fine print and discuss your specific business needs with your insurance provider to make sure you have adequate protection for your fleet. Getting a quote from a provider like The Hartford can help you see what options are available.

When you’re looking at policies, consider bundling your commercial auto insurance with other business policies you might have. This can sometimes lead to discounts and simplifies managing your insurance needs. You can explore options for bundling your company’s vehicle fleet insurance to see potential savings and streamlined management.

Factors Influencing Your Commercial Car Insurance Premiums

So, you’ve got a fleet of vehicles for your business, and now you’re looking at insurance. It’s not just a one-size-fits-all deal, and what you pay can really depend on a bunch of things. Understanding these factors can help you get a better handle on your costs and maybe even find ways to save a bit.

Vehicle Type and Usage

The kind of vehicles you have in your fleet makes a big difference. Are you driving heavy-duty trucks, delivery vans, or sedans for client transport? Each type has its own risk profile. Trucks, for example, often carry higher premiums because they’re typically used for longer distances and can cause more damage in an accident. How you use these vehicles also matters. If your cars are constantly on the road for deliveries or service calls, that increased exposure naturally leads to higher rates compared to vehicles used only occasionally. Think about it: more time on the road means more chances for something to happen. This is why insurers look closely at the specific uses, like long-haul trucking versus local deliveries, when setting your premium. You can compare different types of coverage to see what fits your fleet’s needs best.

Driver History and Experience

This is a big one. The driving records of your employees are a major piece of the puzzle for insurance companies. A history of accidents, traffic violations, or DUIs for any driver in your company will almost certainly drive up your premiums. Insurers see this as a direct indicator of risk. On the flip side, having a team of experienced drivers with clean driving records can actually help lower your costs. It shows the insurance company that your drivers are generally safe and responsible on the road. Keeping your drivers’ records clean is a proactive way to manage your insurance expenses over time. It’s worth looking into how your insurer weighs driver history when calculating your rates.

Business Operations and Location

Where your business operates and the nature of your operations play a significant role too. If your fleet primarily operates in urban areas with heavy traffic and a higher incidence of accidents, your premiums might be higher. Conversely, operating in rural areas with less traffic could lead to lower rates. The type of business also factors in; for instance, a business that transports high-value goods might face different rates than one that transports general merchandise. The claims history of your business is also a key component. Frequent or severe claims can signal higher risk to insurers, impacting your future premiums. It’s important to be upfront about all aspects of your business operations and locations to get an accurate quote.

Insurers look at a wide range of data points to assess the risk associated with your fleet. This includes not just the vehicles themselves, but also who is driving them and where they are being driven. Being transparent and providing accurate information is key to securing the right coverage at a fair price.

Choosing the Right Commercial Car Insurance Policy

Assessing Your Business Needs

Picking the right commercial car insurance isn’t a one-size-fits-all deal. You really need to look at what your business does day-to-day. Think about the types of vehicles you have, how many miles they rack up, and what they’re used for. Are your vans making local deliveries, or are your trucks hauling goods across the country? The more you use your vehicles and the riskier the job, the more coverage you’ll likely need. It’s also smart to consider who’s driving. If you have a mix of experienced drivers and newer ones, that plays a part too. Don’t forget about the value of the vehicles themselves and any equipment you carry inside them. Getting this part right means you won’t be underinsured when something unexpected happens.

Comparing Quotes from Multiple Insurers

Once you have a good idea of what your business needs, it’s time to shop around. Don’t just go with the first quote you get. Prices and coverage can vary a lot between different insurance companies. It’s a good idea to get at least three quotes to compare. When you look at them, don’t just focus on the price. Make sure you’re comparing apples to apples – check that the coverage limits, deductibles, and any add-ons are similar. Sometimes a slightly higher premium can get you much better protection or fewer headaches down the road.

Here’s a quick look at what to compare:

- Coverage Limits: The maximum amount the insurer will pay for a covered loss.

- Deductibles: The amount you pay out-of-pocket before insurance kicks in.

- Specific Coverages: Ensure all the types of protection you need (like liability, physical damage, etc.) are included.

- Perks and Discounts: Look for things like multi-policy discounts or safe driver incentives.

Understanding Policy Exclusions

Every insurance policy has exclusions – things that aren’t covered. It’s super important to know what these are before you sign anything. Common exclusions might include damage from war, intentional acts, or using a vehicle for purposes not listed in the policy. Some policies might also exclude coverage for certain types of cargo or equipment if it’s not specifically added. Reading the fine print might not be the most exciting part of the process, but it can save you a lot of trouble later on.

It’s easy to get caught up in the excitement of finding a good deal, but a policy that looks cheap might end up costing you more if it doesn’t cover what you actually need it to. Always read the policy documents carefully to understand what is and isn’t covered.

Managing Your Commercial Car Insurance

Once you’ve got your commercial car insurance policy sorted, it’s not exactly a ‘set it and forget it’ kind of deal. Think of it more like keeping your fleet running smoothly – it needs regular attention to stay effective and affordable. This means checking in on your coverage periodically and knowing what to do when things go sideways.

Regular Policy Reviews

Life happens, and so do changes in your business. That’s why it’s a good idea to look over your insurance policy at least once a year, or whenever something significant changes. Did you add new vehicles to your fleet? Maybe you expanded your service area or changed how you use your vehicles? These kinds of shifts can affect your coverage needs and, consequently, your premiums. Failing to update your policy could leave you underinsured or paying for coverage you no longer need. It’s also a good time to see if there are new discounts or better policy options available from other providers. You might be surprised at how much you can save just by comparing what’s out there. For instance, some insurers offer discounts for using telematics devices, which can track driver behavior and vehicle usage, potentially leading to lower rates if your fleet operates safely. This proactive approach helps keep your insurance aligned with your business reality.

Navigating Claims Processes

When an accident happens, the last thing you want is to be confused about how to file a claim. Most insurance providers have a clear process, but it’s best to be familiar with it beforehand. Typically, you’ll need to gather information about the incident, including:

- Details of the vehicles and drivers involved

- Police report number, if applicable

- Witness information, if any

- Photos of the damage

Keep all this documentation organized. Contact your insurance agent or the claims department as soon as possible after the incident. They can guide you through the next steps, which might involve an adjuster assessing the damage. Understanding the claims process can make a stressful situation a bit more manageable. It’s also helpful to know if your policy includes things like rental reimbursement, which can keep your business moving while your vehicle is being repaired.

Cost-Saving Strategies

Keeping a lid on insurance costs is always a priority for businesses. Beyond regular policy reviews, there are other ways to potentially lower your premiums. Consider these strategies:

- Improve Fleet Safety: Implement strict safety protocols for your drivers and maintain your vehicles regularly. A good safety record can lead to lower rates. Using telematics can help monitor driving habits and identify areas for improvement.

- Increase Deductibles: If your business can afford to cover a slightly higher out-of-pocket expense in the event of a claim, increasing your deductibles can lower your overall premium. Just make sure the deductible amount is manageable for your business.

- Bundle Policies: If your insurer offers other types of business insurance, like general liability or property insurance, see if bundling them with your commercial auto policy provides a discount. This can simplify your insurance management and potentially save money.

- Review Vehicle Usage: Ensure your vehicles are classified correctly based on their actual use. Misclassifying vehicles can lead to higher premiums. For example, if a vehicle is now used for local deliveries instead of long-haul transport, your premium might adjust. You can explore options like usage-based insurance if your driving patterns are predictable and safe. Learning about different insurance options, like those offered by providers such as ICBC, can also help you find the most suitable and cost-effective coverage for your specific fleet needs. Explore available choices to find the right protection.

Proactive management of your commercial car insurance isn’t just about saving money; it’s about ensuring your business has the right protection when you need it most. Staying informed and engaged with your policy and provider is key to long-term success and peace of mind.

Keeping your commercial car insurance in good shape is important. We make it easy to understand and manage your policy. Want to learn more about how to get the best coverage for your business vehicles? Visit our website today for helpful tips and resources!

Final Thoughts on Commercial Auto Insurance

So, getting the right commercial auto insurance for your business fleet might seem like a lot. You have to think about what kind of coverage you really need, compare different companies, and make sure you’re not paying too much. It’s not just about having insurance, it’s about having the right insurance. Taking the time to figure this out now can save you a lot of headaches and money down the road if something unexpected happens. Your business vehicles are important, so making sure they’re properly protected is just smart business.

Frequently Asked Questions

What exactly is commercial car insurance?

Commercial car insurance is like regular car insurance, but it’s specifically for vehicles used for business purposes. Think of delivery trucks, company cars, or vans used for a service. It helps protect your business if one of these vehicles is in an accident.

Why do I need special insurance for business cars?

Using a car for business often means more driving, carrying different kinds of loads, or having employees drive it. This can increase the risk compared to personal use. Standard car insurance might not cover accidents that happen while you’re working, leaving your business exposed to costs.

What kind of coverage is usually included?

Most commercial policies include liability coverage, which pays for damage or injuries you cause to others. They also often cover damage to your own vehicles (physical damage) and protection if you’re hit by someone with no or little insurance (uninsured/underinsured motorist coverage).

How do insurance companies decide how much to charge?

Several things affect the price. They look at the types of vehicles you have, how you use them (like long-haul deliveries versus local service calls), the driving records of your employees, and where your business is located. The more risk involved, the higher the cost might be.

What’s the best way to get the right insurance for my business?

First, figure out exactly what your business needs. How many vehicles do you have? What do they carry? Then, get quotes from a few different insurance companies. Compare not just the price, but also what each policy covers to make sure you’re getting the best deal for your specific situation.

Can I do anything to lower my business auto insurance costs?

Yes! Maintaining a good driving record for all your drivers is key. You can also look into safety programs for your employees, choose vehicles that are known for safety, and make sure you’re not over-insuring. Regularly reviewing your policy to ensure it still fits your needs can also help you avoid paying for coverage you don’t need.