Hey everyone! So, I’ve been thinking a lot about personal finance lately, and it can get pretty overwhelming, right? Like, where do you even start with all the different options out there? I wanted to break down some of the basics, especially when it comes to things like car financing, which can be a real head-scratcher. Understanding the fundamentals of things like COE, for instance, is super important if you’re looking at buying a car here. We’ll cover a bunch of topics, from financial planning to investing and even how your CPF works. Let’s try to make sense of it all together.

Key Takeaways

- When financing a car, especially one with a renewed COE, expect potentially higher interest rates and stricter loan terms. It’s wise to compare effective interest rates (EIR) and consider loan tenures that fit your budget.

- Value investing focuses on a company’s competitive advantages, like brand loyalty or cost efficiency, and the quality of its management to identify long-term potential.

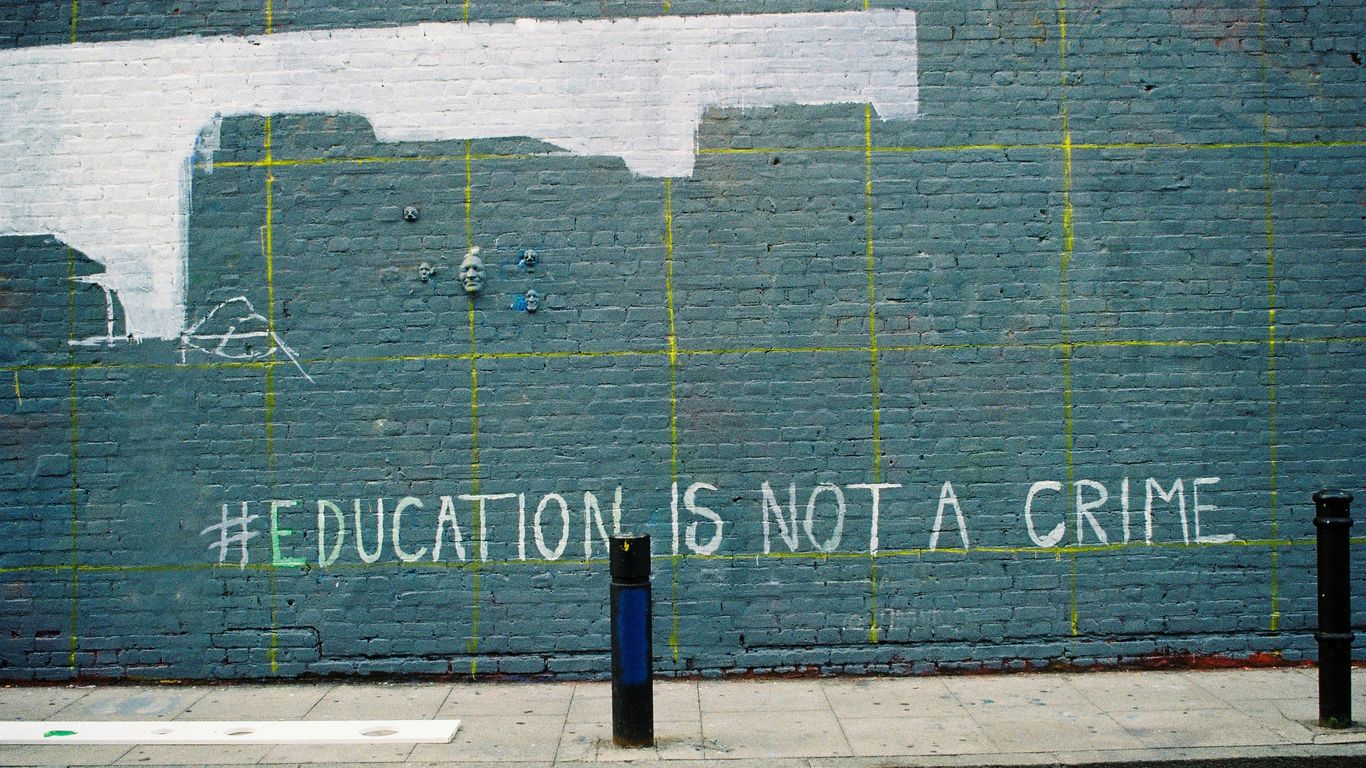

- Education planning involves budgeting for school costs, setting up savings plans, and investing to grow funds for your child’s future schooling needs.

- Insurance policies should be assessed based on how well they meet your personal situation and goals, not just fees or potential returns. Flexibility and transparency in costs are also important.

- Understanding your CPF contributions and interest rates is key for retirement savings. Voluntary contributions can boost your retirement funds, and various CPF schemes can help with healthcare costs.

Understanding The Core Components Of Financial Planning

Getting your finances in order might seem like a big task, but it really boils down to a few key areas. Think of it like building a house; you need a solid foundation before you start putting up walls. Financial planning is all about setting up that strong base so you can build towards your future goals, whatever they may be.

Defining Financial Planning

At its heart, financial planning is the process of managing your money to achieve your life goals. It’s not just about saving; it’s a broader approach that looks at your income, expenses, savings, investments, and insurance all together. The main idea is to make your money work for you, helping you live the life you want now and in the future. It involves understanding where you are financially, where you want to go, and creating a map to get there. This includes things like making sure you have enough for daily living, planning for big purchases, and preparing for unexpected events.

The Wedding Cake Strategy Framework

This is a way to visualize how different financial elements fit together. Imagine a wedding cake with multiple tiers. The base tier is your emergency fund – the absolute must-have that keeps everything stable. On top of that, you have your insurance, which protects you from major financial shocks. The next tiers might represent your savings for specific goals, like a down payment on a house or your children’s education. Finally, the top tier is your long-term investments, aimed at growing your wealth for retirement or other future aspirations.

Here’s a simple breakdown:

- Base: Emergency Fund (6 months of living expenses)

- Second Tier: Protection (Insurance like health, life, disability)

- Third Tier: Savings Goals (Short to medium-term objectives)

- Top Tier: Investments (Long-term wealth growth)

Importance of Financial Planning

Why bother with all this? Well, life throws curveballs. Without a plan, unexpected events like job loss or a medical emergency can derail your finances completely. Proper planning helps you build a safety net, like an emergency fund, so you’re not caught off guard. It also helps you stay on track with your goals, whether that’s buying a home, funding your children’s education, or retiring comfortably. Think about it: if you don’t have a clear plan, how will you know if you’re making progress? It’s about taking control of your financial future rather than letting it happen to you. You can explore resources to help you get started on your financial planning journey.

Managing your money effectively isn’t just about accumulating wealth; it’s about creating security and freedom for yourself and your loved ones. It provides a clear path forward, reducing stress and increasing your ability to enjoy life’s opportunities.

Navigating Insurance Policies For Comprehensive Coverage

Insurance can feel like a maze, right? It’s easy to get lost in all the different types of policies and what they actually cover. But getting it right means you’re protected when unexpected things happen, and you’re not paying for coverage you don’t need. Let’s break down how to make sense of it all.

When you’re looking at insurance, the most important thing is how well it fits your life. It’s not just about buying a product; it’s about finding a solution for your specific needs. Think about what you want to protect – your income, your family, your home, your health. Does the policy actually address those things?

Here are some key questions to ask yourself:

- What are my current life circumstances? Have you recently bought a house, had a child, or changed jobs? These events change your insurance needs.

- What are my financial goals? Are you saving for retirement, your kids’ education, or something else? Your insurance should support these goals, not hinder them.

- What are my biggest risks? Are you worried about a critical illness, a long-term disability, or something happening to your income?

It’s also important to look beyond just the price tag. Sometimes a cheaper policy might not offer the coverage you truly need, or it might have hidden fees that add up over time. Transparency is key here.

Understanding the fine print is not just a suggestion; it’s a necessity. What seems like a small exclusion today could become a major issue down the line if an unexpected event occurs.

Insurance policies aren’t always set in stone. Many offer features that can make them more useful for you over time. Consider how flexible the policy is. Can you adjust your premiums if your income changes? Are there options for partial withdrawals if you need cash in an emergency? What happens if you need to make changes to your coverage later on?

Some policies might have features like:

- Premium holidays: The ability to pause premium payments for a period without losing coverage.

- Riders: These are add-ons that provide extra coverage, like for early critical illnesses or accidental death. They can tailor the policy more closely to your needs.

- Cash value: Some policies, like whole life insurance, build up a cash value over time that you can borrow against or withdraw.

It’s also worth comparing different types of insurance to see what makes the most sense for your situation. For example, term life insurance is generally more affordable and offers higher coverage for a specific period, while whole life insurance offers lifelong coverage and a savings component, but at a higher cost.

Critical illness (CI) coverage is a big one for many people. It pays out a lump sum if you’re diagnosed with a serious illness, which can help cover medical expenses, replace lost income, or pay for care. When looking at CI riders, consider what illnesses are covered and if there are limits on the number of claims you can make.

Some policies cover early, intermediate, and advanced stages of illnesses, and some even allow for multiple claims if you suffer from different conditions or the same condition multiple times. This can be really important because survival rates for some illnesses are improving, meaning you might live with a condition for a long time.

For instance, if you were diagnosed with cancer, the payout from a CI policy could help cover treatment costs and allow you to take time off work to focus on recovery without worrying about immediate bills. It’s about having a financial cushion during a difficult time.

It’s a good idea to compare how different insurers handle CI coverage, as the definitions of illnesses and the payout structures can vary quite a bit. This way, you can pick a policy that offers the most relevant protection for you.

Strategic Approaches To Education Funding

Planning for your child’s education is a big step, and it’s smart to think about it early. The costs can add up, and it’s not just about tuition fees. Think about books, living expenses, and maybe even extracurricular activities.

Components of Education Planning

Education planning involves several key parts. You need to figure out what kind of education you want for your child, whether it’s local or overseas, and what specific courses they might be interested in. Then, you have to estimate the costs associated with that. This includes tuition, but also living costs, books, and other expenses.

- Tuition Fees: The main cost, which can vary greatly depending on the institution and program.

- Living Expenses: This covers accommodation, food, transportation, and personal needs.

- Materials and Books: Textbooks, stationery, and other study supplies.

- Miscellaneous Costs: This could include things like field trips, project materials, or even potential overseas study trips.

Importance of Early Education Planning

Starting early makes a huge difference. The earlier you begin saving, the less you’ll need to put aside each month. This is because of the power of compounding. Even small, consistent contributions over a long period can grow significantly.

The cost of education has been steadily increasing over the years. Factoring in inflation is key to ensuring your savings will be sufficient when the time comes. Without proper planning, you might find yourself short of funds, forcing you to dip into retirement savings or take out high-interest loans.

For example, if you need to save a certain amount over 20 years, starting early means smaller monthly payments compared to starting later when the time horizon is shorter. This makes the financial commitment more manageable. It’s also worth noting that if your child receives scholarships or bursaries later on, those funds can be redirected to other goals, like a down payment for a home or even your own retirement. You can use a free education fund calculator to get a clearer picture of future costs.

Available Financial Assistance for Education

There are various ways to get help with education costs. Government grants and subsidies are available, and these can significantly reduce the financial burden. For instance, the government is increasing non-repayable grants for students, which can help a large number of young Canadians.

Some common forms of financial assistance include:

- Government Grants and Subsidies: Programs designed to make education more accessible.

- Scholarships and Bursaries: Merit-based or need-based awards that don’t need to be repaid.

- Study Loans: Loans specifically for education, often with favorable repayment terms.

- CPF Education Loan Scheme: Allows the use of CPF funds for tuition fees, with accrued interest to be repaid.

It’s also important to look into specific schemes like the Child Development Account (CDA) which can provide substantial funds for a child’s development and education. Understanding these options can help you build a robust plan for your child’s future.

Understanding Car Financing Options

Buying a car is a big step, and figuring out how to pay for it is a big part of that. In places like Singapore, where car ownership costs are pretty high, most people need a car loan to make it happen. It’s basically borrowing money to buy the car, and then you pay it back over time with interest. This lets you get a car without having to pay the full price all at once.

Car Loan Tenures and Borrower Profiles

When you’re looking at car loans, the length of the loan, or tenure, really matters. You can usually pick a loan term from 3 to 7 years. A shorter loan means you’ll pay more each month, but you’ll pay less interest overall. If you choose a longer loan, your monthly payments will be smaller, which might feel easier on your wallet, but you’ll end up paying more in total interest by the time you’re done. It’s a trade-off between monthly cost and total cost.

Your personal situation as a borrower also plays a big role. If you have a steady job and a good credit history, banks usually see you as less of a risk. This often means easier approval and better interest rates. People who are self-employed or have income that changes a lot might find it a bit harder to get approved by traditional banks. They might need to show more documents, like tax assessments or bank statements, to prove their income. Sometimes, alternative lenders might be an option for these individuals, but it’s important to check their terms carefully.

Financing Renewed Certificates of Entitlement (COE)

Renewing your Certificate of Entitlement (COE) is another common scenario for car owners in Singapore. When you renew your COE, you’re essentially extending your car’s eligibility to be on the road for another 10 years. Financing this renewal can be done through specific loans. These loans might have different terms compared to loans for new cars, often aligning with the remaining lifespan of the car and its COE. It’s a way to keep your existing vehicle without paying the full renewal cost upfront. You might find that lenders have stricter rules or shorter loan periods for COE-renewed cars because the vehicle is older. It’s worth comparing different lenders to see who offers the best rates and terms for this specific situation. You can find options for financing renewed COEs that might suit your needs.

Green Car Loans for Electric Vehicles

With the growing interest in electric vehicles (EVs), some banks now offer ‘green car loans’. These loans are specifically for buying EVs or hybrid cars. They often come with slightly better interest rates compared to regular car loans, maybe a small discount. Some might even include perks like carbon offsetting or free charging credits. While these loans are a nice incentive, it’s important to remember that the basic mechanics of the loan are still the same. You’re still borrowing money and paying it back over time. It’s a good idea to compare these green loans with standard car loans to make sure you’re getting the best deal overall.

When looking for a car loan, always ask for the Effective Interest Rate (EIR), not just the advertised flat rate. The EIR gives you a clearer picture of the true cost of borrowing because it accounts for compounding interest and fees over the loan’s life. Comparing EIRs across different lenders will help you make a more informed decision about which loan is truly the most affordable for you.

Here’s a look at how loan tenures can affect your payments:

| Loan Tenure | Monthly Payment | Total Interest Paid |

|---|---|---|

| 3 Years | Higher | Lower |

| 5 Years | Medium | Medium |

| 7 Years | Lower | Higher |

Remember, car financing is a tool to help you acquire a vehicle, but understanding the details of the loan is key to managing your finances effectively.

Key Principles Of Value Investing

Value investing is a strategy focused on buying stocks that the market has undervalued. It’s like finding a good deal at a sale – you’re getting something for less than it’s actually worth. The idea is that eventually, the market will recognize the company’s true worth, and the stock price will go up. This approach often leads to more stable investments, especially when the market is shaky, because you’re not overpaying for the stock to begin with. It’s a long-term game, requiring patience and a belief in the company’s underlying strength.

Identifying a Company’s Competitive Moat

A company’s "moat" refers to its competitive advantage, the things that protect it from rivals and help it stay profitable. Think of it like a castle’s moat – the wider and deeper it is, the harder it is for enemies to get in. This advantage can come from a few places:

- Brand Loyalty: Like Apple, where customers are willing to pay more because they like the brand.

- Patents or Unique Technology: Companies with exclusive rights to a product or process have a big edge.

- Cost Advantages: Being able to produce things cheaper than competitors gives a pricing advantage.

- Network Effects: Services like social media become more valuable as more people use them, making it tough for new players.

- Switching Costs: When it’s difficult or expensive for customers to switch to a competitor, like with certain software or services.

A strong, wide moat is a sign of a company that can likely keep its edge and profits over time.

The Role of Management in Long-Term Success

Even the best business idea can fail if the people running the company aren’t good at their jobs. Strong management is key. You want leaders who have a clear plan for growth and can actually carry it out. This means they need to be smart about how they use money, guide the company through tough times, and make good decisions consistently. Looking at a management team’s past performance and their vision for the future can tell you a lot about a company’s potential.

Understanding Business Models and Revenue Streams

Before investing, it’s important to understand how a company makes money. What is its business model? How does it bring in revenue? This involves looking beyond just the numbers and understanding the actual operations of the business. For example, some companies rely on selling products, others on subscriptions, and some on advertising. Knowing this helps you assess the sustainability and potential for growth in their revenue streams. It’s about grasping the "meaning" behind the business you’re putting your money into. You can find more information on evaluating investment objectives.

Value investing requires a deep dive into a company’s fundamentals, not just its stock price. It’s about finding quality businesses that are temporarily out of favor with the market.

Maximizing Investment Potential

When you’re looking to grow your money, it’s not just about picking stocks or funds. It’s about having a plan and sticking to it. Think of it like building something – you need the right materials and a good blueprint. For investors, this means understanding your own goals and how much risk you’re comfortable with. This personal assessment is the first step to making smart investment choices.

Evaluating Investment Objectives and Risk Tolerance

Before you put any money anywhere, take a moment to figure out what you actually want to achieve. Are you saving for a down payment in five years, or are you planning for retirement decades from now? Your timeline makes a big difference. Then, consider your risk tolerance. Some people can sleep soundly even if their investments drop a bit, while others get anxious. Knowing this helps you pick investments that won’t keep you up at night.

Here’s a simple way to think about it:

- Short-term goals (1-3 years): Usually call for lower-risk options, like short-term bonds or money market funds. The main goal is preserving capital.

- Medium-term goals (3-10 years): You might consider a mix of stocks and bonds, balancing growth with some stability.

- Long-term goals (10+ years): Often allow for higher-risk, higher-growth potential investments, like stocks or equity funds, because you have time to ride out market ups and downs.

It’s also helpful to look at how your investments are performing relative to the risk you’re taking. Metrics like the Sharpe ratio can give you a clearer picture of risk-adjusted returns.

Exploring Diverse Investment Products

There’s a whole world of investment options out there, beyond just savings accounts. You’ve got stocks, bonds, exchange-traded funds (ETFs), mutual funds, and even real estate investment trusts (REITs). Each has its own way of working and its own potential for growth and risk.

- Stocks: Represent ownership in a company. They can offer high growth but also come with higher volatility.

- Bonds: Essentially loans you make to governments or corporations. They’re generally less risky than stocks but also tend to offer lower returns.

- ETFs and Mutual Funds: These pool money from many investors to buy a basket of assets, like stocks or bonds. They offer instant diversification, which is a good way to spread out your risk. You can find ETFs that track broad market indexes or focus on specific sectors.

- REITs: Allow you to invest in real estate without directly owning property. They can provide income through rent and potential capital appreciation.

Choosing the right mix depends on your goals and risk tolerance. Diversifying across different types of assets is a smart move to maximize investment returns.

Strategies for Future Financial Growth

Once you’ve got your investments in place, the work isn’t over. You need to keep an eye on them and make adjustments as needed. This means regularly reviewing your portfolio to make sure it still aligns with your objectives. Sometimes, market changes or shifts in your personal life might mean you need to rebalance your holdings. Using tax-advantaged accounts, like those offered through CPF, can also help you enhance your investment income and keep more of your returns.

Staying informed and making periodic adjustments are key to long-term success. It’s about being patient and letting your investments work for you over time, rather than trying to time the market.

CPF Contributions And Retirement Savings

The Central Provident Fund (CPF) is a cornerstone of Singapore’s social security system, designed to help citizens save for retirement, healthcare, and housing needs. Understanding how your CPF contributions work and how to maximize them is key to a secure financial future.

Understanding CPF Interest Rates

Your CPF savings grow over time thanks to interest earned. Different CPF accounts offer different interest rates. The Ordinary Account (OA) earns a base interest rate, while the Special Account (SA) and MediSave Account (MA) typically earn a higher rate. It’s important to be aware of these rates as they directly impact how quickly your savings accumulate.

Here’s a general look at the interest rates:

- Ordinary Account (OA): Earns 2.5% per year.

- Special Account (SA) & MediSave Account (MA): Earn 4% per year.

- Retirement Account (RA): Earns 4% per year.

- Extra Interest: An additional 1% is earned on the first $60,000 of combined CPF balances (up to $20,000 from OA).

Voluntary Contributions to Retirement Savings

While CPF contributions are mandatory for most employees, you can also make voluntary contributions to boost your retirement savings. This can be done through the Retirement Sum Topping-Up Scheme (RSTU). Topping up your CPF accounts, especially the SA, can help you reach your retirement sum goals faster and benefit from the higher interest rates. This is a good strategy if you have surplus funds and want to grow your retirement nest egg.

CPF Schemes for Healthcare Needs

Beyond retirement, CPF also plays a significant role in covering healthcare expenses. The MediSave account is specifically designed for this purpose. You can use your MediSave funds for various medical treatments, hospitalisation bills, and premiums for health insurance plans like MediShield Life and Integrated Shield Plans. Understanding how to utilize your MediSave effectively can help manage healthcare costs throughout your life. CPF is a crucial part of Singapore’s social security system.

Planning for retirement involves understanding all the components of your CPF savings and how they can be best utilized to meet your long-term financial goals. Making informed decisions about voluntary contributions and understanding the interest earned can make a significant difference in your retirement security.

Thinking about your future and how to save for when you stop working? Understanding your CPF contributions is key to building a solid retirement fund. It’s not as complicated as it sounds! Learn how to make your money work harder for your golden years. Visit our website today to get started on planning your retirement.

Wrapping Up Your COE Knowledge

So, we’ve gone over what COE is all about. It’s a big part of buying a car here, and understanding it can save you some headaches down the road. Whether you’re looking at a new car or thinking about renewing your existing one, knowing the ins and outs of COE pricing and how it affects your overall cost is pretty important. It’s not the most exciting topic, but getting a handle on it means you can make smarter choices when it comes to your vehicle. Keep this info handy, and good luck with your car journey!

Frequently Asked Questions

What is the main goal of financial planning?

Financial planning is all about making a smart plan for your money. It helps you figure out how to save, spend, and invest so you can reach your future goals, like buying a house or retiring comfortably. Think of it like creating a roadmap for your money journey.

Why is it important to have insurance?

Insurance acts like a safety net for unexpected events. If something bad happens, like an illness or an accident, insurance can help cover the costs so you don’t have to use all your savings. It’s about protecting yourself and your loved ones from financial hardship.

What’s the ‘wedding cake strategy’ in finance?

The wedding cake strategy is a way to build your finances step-by-step, starting with the most important layers at the bottom. It suggests focusing on essential needs first, then gradually adding other financial goals, much like building a cake from its base upwards.

How does COE affect car financing?

COE, or Certificate of Entitlement, is a big part of a car’s price in Singapore. When you renew your COE, it can mean higher interest rates on car loans because the car is older. Lenders might also have stricter rules for these loans.

What is ‘value investing’?

Value investing is like being a treasure hunter for stocks. It means looking for companies that seem to be worth more than their stock price suggests. You buy these ‘undervalued’ stocks hoping their price will go up later, focusing on the company’s real worth, not just market trends.

Why should I plan for my child’s education early?

Planning for your child’s education early is super important because school costs can add up quickly over the years. By starting early, you can save and invest gradually, making it easier to afford quality education without a huge financial strain later on.